Hauptinhalt

Lending is here to stay.Numbers prove it.

$995 bln

Buy now, pay later

market size in 2026.

Source: Juniper Research

900 mil

BNPL users by 2027.

Source: Juniper Research

82%

of consumers appreciate the simple application process for BNPL.

Source: Credi2 study, 2021

Top 5 benefits

Banks and issuers set the digital financing standard with credi2's Embedding Lending-as-a-service platform for any instalment or BNPL product.

- Fast time to market

- Growth: reach Gen Y & Z

- Online. Mobile. Point of Sale

- White-label end-to-end solution

- Reduce implementation efforts and costs

The market favors lendersto take over.

Embedded Lendinguse cases

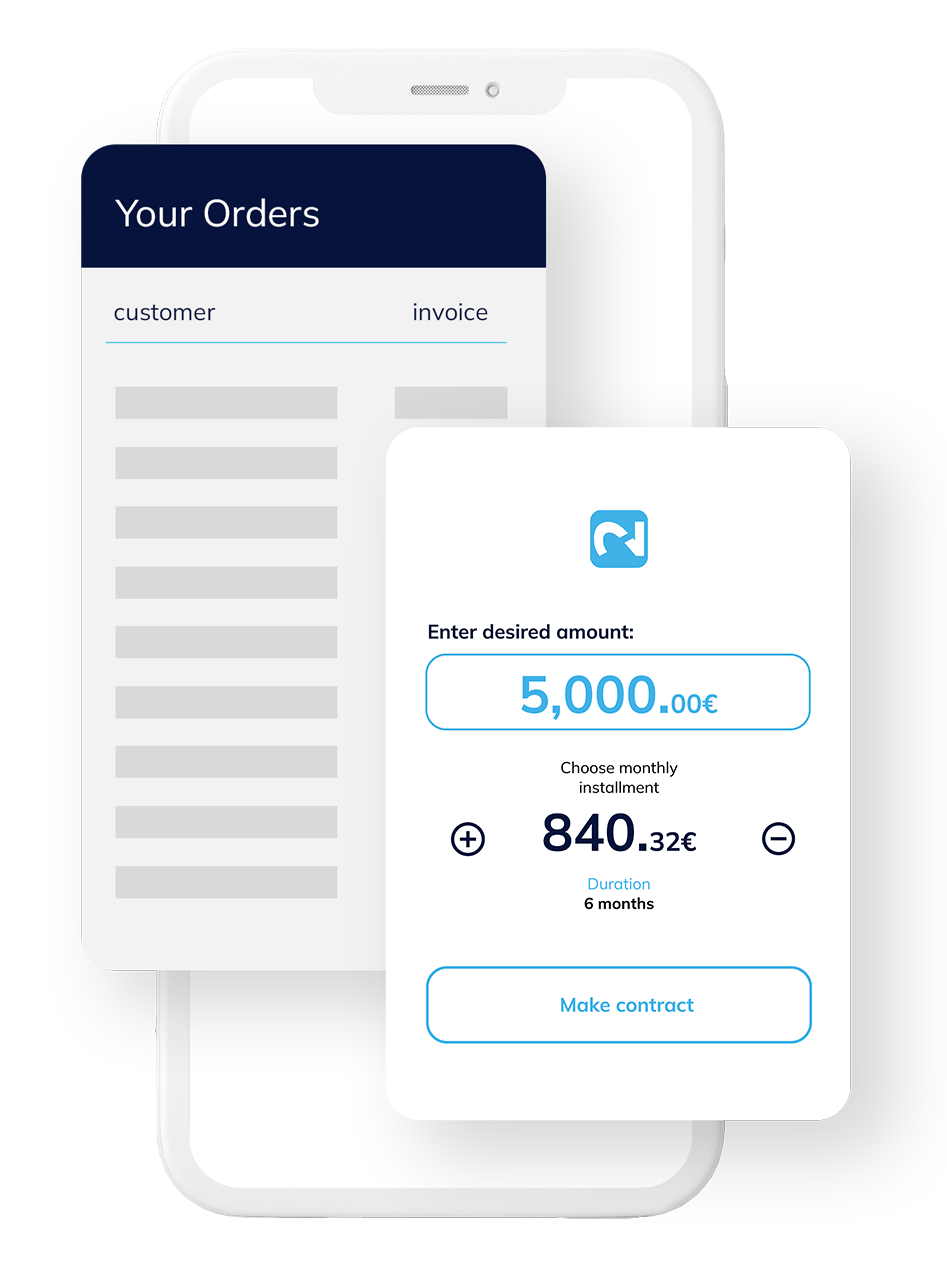

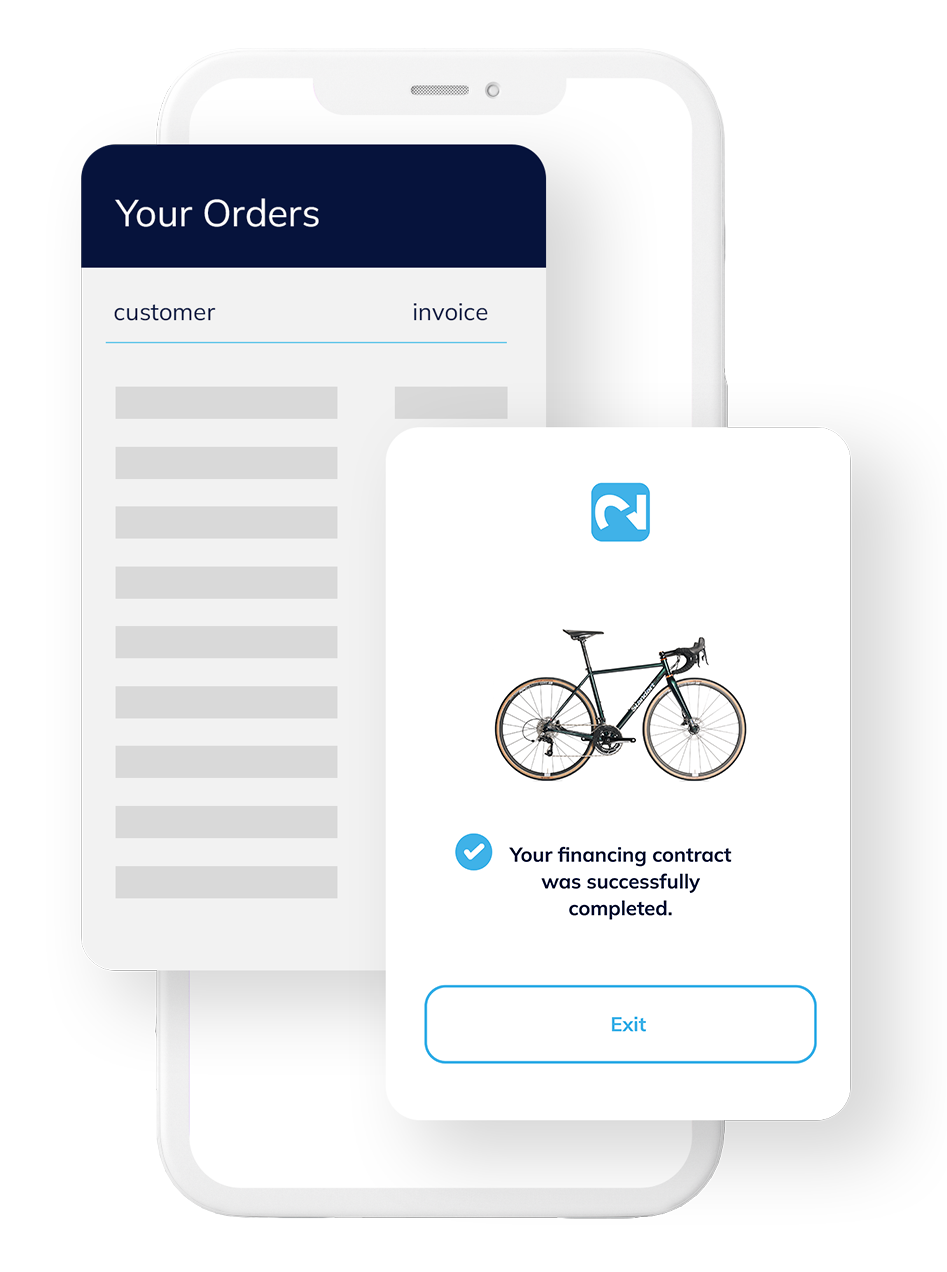

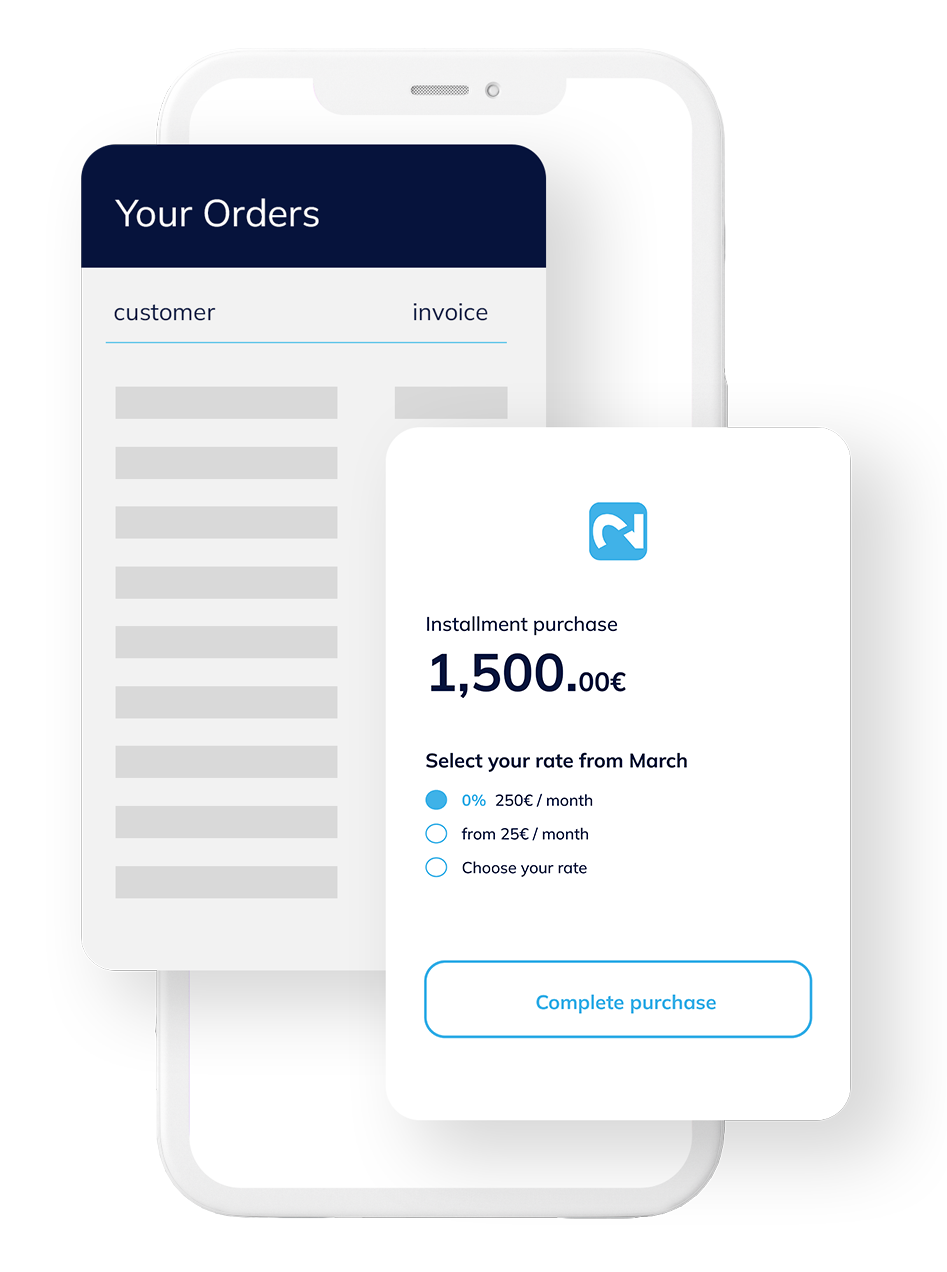

Embedded financing covers any pre-, during-, and post-purchase use cases along the customer journey. With any instalment or BNPL product.

What our customers say

The best financing product for your business model.

Credi2's BNPL platform offers four flexible white-label financing products. Easily embedded at any payment touchpoint.

Latest news

Launching a card-led installment product: The challenges

Read more

Card-led pay later solutions are here to stay

Read more

Lets go into the details.Top FAQ's

The credi2 solutions offer a variety of risk- and onboarding models for customers. From a simple credit scoring including basic identification and fraud prevention mechanisms up to a fully AML-compliant customer onboarding including QES service can be provided. The provided models and processes comply with regulatory requirements to fit the products offered best.

The risk and onboarding solution of credi2 services are configured and setup based on your individual needs and specifications. All solutions can be adjusted to your needs ranging from incorporation your preferred partners to utilization of your existing models and services.

Customer and merchant portals can be provided and offer e.g. transaction and payment overviews, payment management and reporting and document management capabilites.

All services and solutions can be operated as white label services or as partner branded solutions.