Hauptinhalt

“Buy now pay later” - a huge trend in the payment industry, a powerful occurrence across industries, and a massive opportunity for lenders and issuers. It is the bandwagon that everyone is jumping on, racing to reach a significant position in the market. A market that is said to increase to $895 bn by 2027. It seems like everyone has figured it out. Consumer facing fintechs such as Klarna or ratepay have paved the way for players such as Apple which launched their BNPL product Apple Pay Later. Huge financial institutions have also caught wind of the potential and decided to launch their own solutions. A lot has been happening in the past years and many products have been introduced to consumers with great enthusiasm.

Consumers prefer installments

To cover the entire consumer journey and complete the offer for all payment needs, pay later options are now ranging from pre-purchase, at-purchase and post-purchase solutions. The latter of which includes card-led installments. A convenient and popular way for consumers to split their credit card purchases comfortably via app after shopping. In fact, personal loans spend has decreased by 17,7% while installment spend has increased by 11,4%. Considering all the various players in the pay later landscape along with recent developments in the industry, it is undeniable that lenders in particular have quite a favorable position.

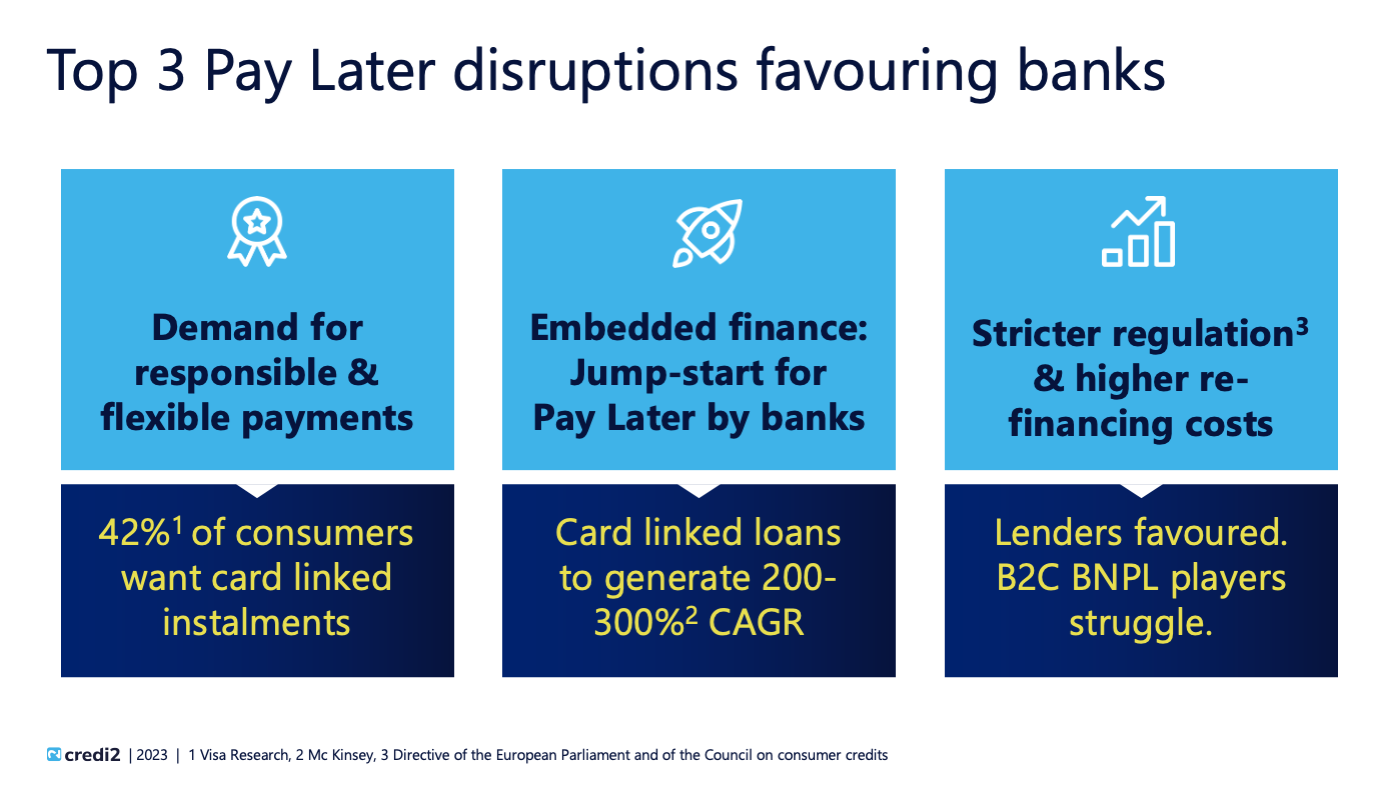

The demand for responsible and flexible payments is constantly rising, in fact 42% of consumers want card linked installments, which plays in the hands of financial institutions. Besides, while stricter regulations and higher refinancing costs are posing a hurdle for consumer facing fintechs, lenders can sit back and continue with business as usual as they already comply with rather strict regulations.

Internal banking systems are not entirely ready for integration

Even though lenders have a quite favorable position in the pay later landscape, they often struggle to introduce their own solutions. To be precise, 79% of lenders state that their systems are not BNPL ready, according to a credi2 study. In conversations with clients we found out that banks are oftentimes hindered by their own lack of know-how and IT resources. Another reason that is often brought up is the complexity of the core banking systems. Costs and the ongoing operated automation, as well as UX and time-to-market also play an important role. Why is it that lenders, despite having a profound understanding of the credit business and immense expertise in all things finance, are having a hard time entering the market and how can this be solved?

Here is a concise list of possible solutions we came up with to the three major questions in regards to lenders’ struggles to offer they own card-led products:

1. Why do lenders have a hard time catching up with the trend of card-led installments in terms of their internal systems?

- Banks predominantly operate as part of large banking groups and its respective group wide systems, which mostly require building BNPL features from scratch. Disruptors on the other hand do not have this limitation. Moreover, each subsidiary in their respective markets has its specifics due to various factors.

- Regulation

- Customer behavior

- Consumer needs

- Digital environment as a basis (legally and technologically)

2. How can this be solved?

- Enable protective measures on BNPL featured products for all sorts of “pay later” products - be to credit, debit or factoring based.

- Especially leverage the untapped post-purchase potential as BNPL predominantly focused on at-purchase and eCommerce transactions

- Encourage uncomplicated risk based consumer profiling approach with the aim to protect the consumer. Linked to the “open to buy” credit card limit

- Create a simple and intuitive experience with time and effort saving actions

- Leverage existing products with smart pay later add-ons for a competitive edge and seamless payment journey

- Deploy BNPL features on products sooner rather than later with an embedded finance approach to save time, money and leverage best in class white-label solutions

3. What do banks need to focus on first?

- Act fast and offer consumers a competitive edge to secure the consumer interface

- Rely on the embedded finance experts’ know how and fair conditions

- Bypass the existing core banking system where needed to ensure a fast time to market to mitigate internal IT dependencies