Hauptinhalt

Split pay is here to stay.Numbers prove it.

11,4%

installment spend

increase

2017-2022

Source: credi2

42%

of consumers want

card-led installments

Source: Visa

300%

CAGR to be

generated by

card-linked loans

Source: credi2

Instalment on cardsdisrupt the credit landscape.

Top use casesfor instalment on cards

Issuer based instalments use cases range from pre-purchase and real time to post-purchase.

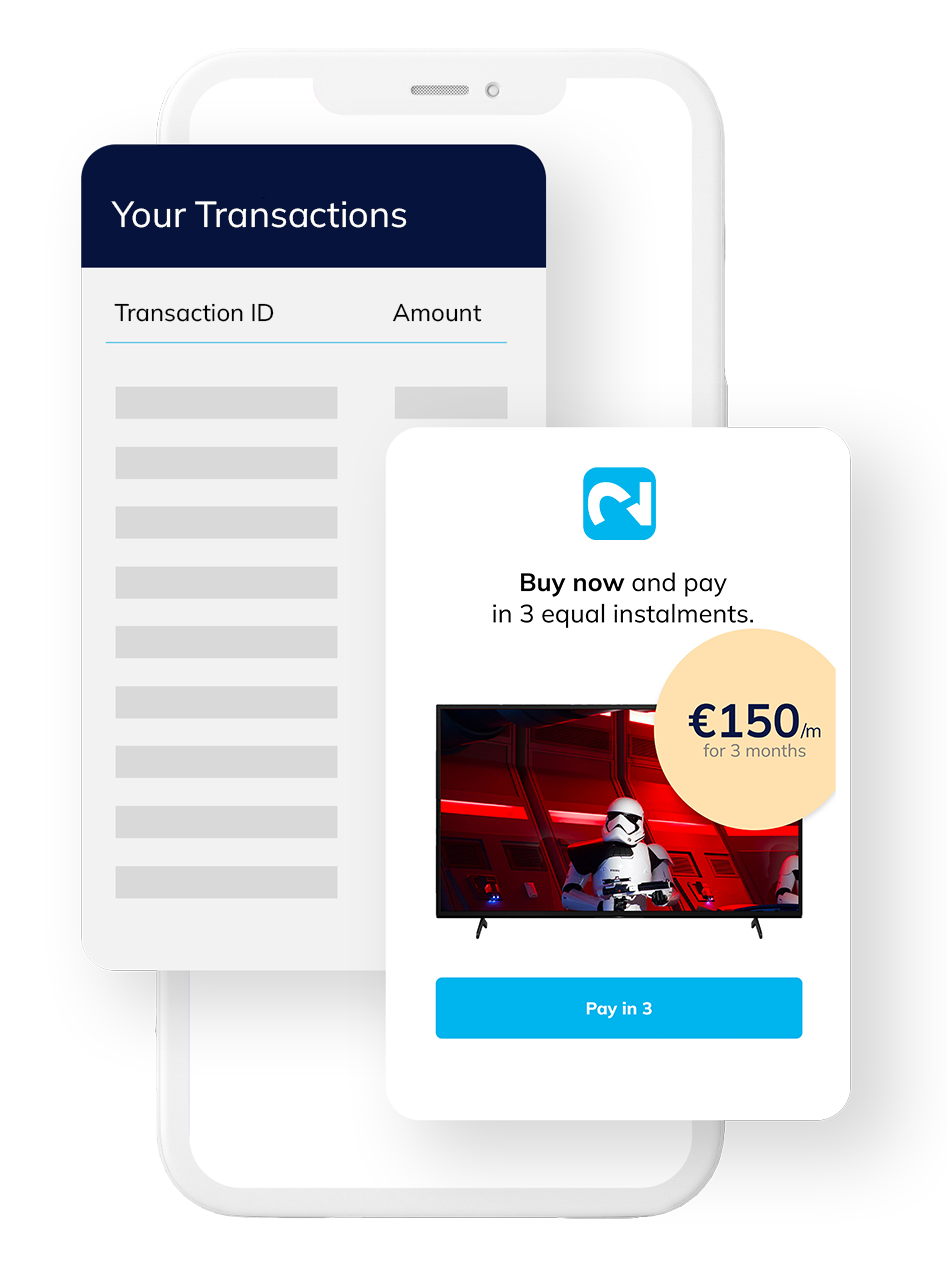

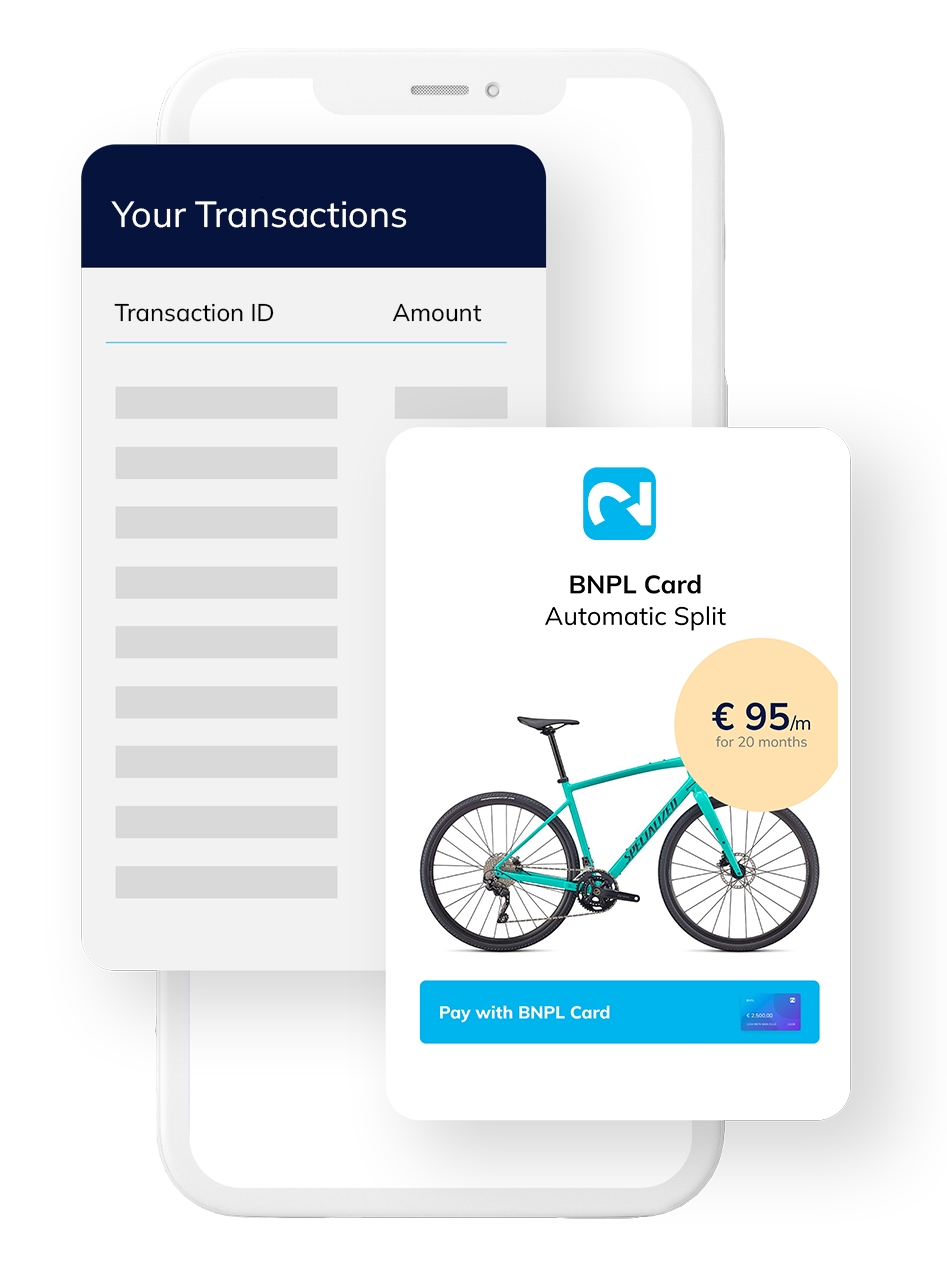

Card-led instalment productsFor credit or debit cards.

Credi2's BNPL platform offers three card-led options.

Easily embedded with maximum convenience.

Credi2 Blog

Launching a card-led installment product: The challenges

Read more

Card-led pay later solutions are here to stay

Read more

We are ready to work together.

FAQs

Merchants leverage the following advantages:

1. Trust and relationship with existing partnering bank

2. Customer trust in established bank

3. Labeling BNPL service with merchant branding and deep intergration

4. Reduction of operational effort and costs at the merchant

5. Reown customer journey and data to optimize Customer life time value

The payout comes from the bank operating the BNPL solution.

In most cases credi2 operates the customer service on behalf of the bank for technical and consumer related support.

Yes. That's one of the core advantages of white label based BNPL solutions.