Hauptinhalt

Expanding consumer needs for digital and flexible payment options is changing the pay later landscape at a remarkable pace. There has been a notable shift in the demand for pay later options, which is moving beyond consumer facing fintechs towards classic credit / loan providers. Issuer-led loans will take up more and more space in the pay later world. Apple Buy Now Pay Later is a good example that card-led installments will challenge existing BNPL offerings. We have seen numerous issuers and schemes entering the pay later market with similar solutions. The latest of which is the leading credit card scheme Visa.

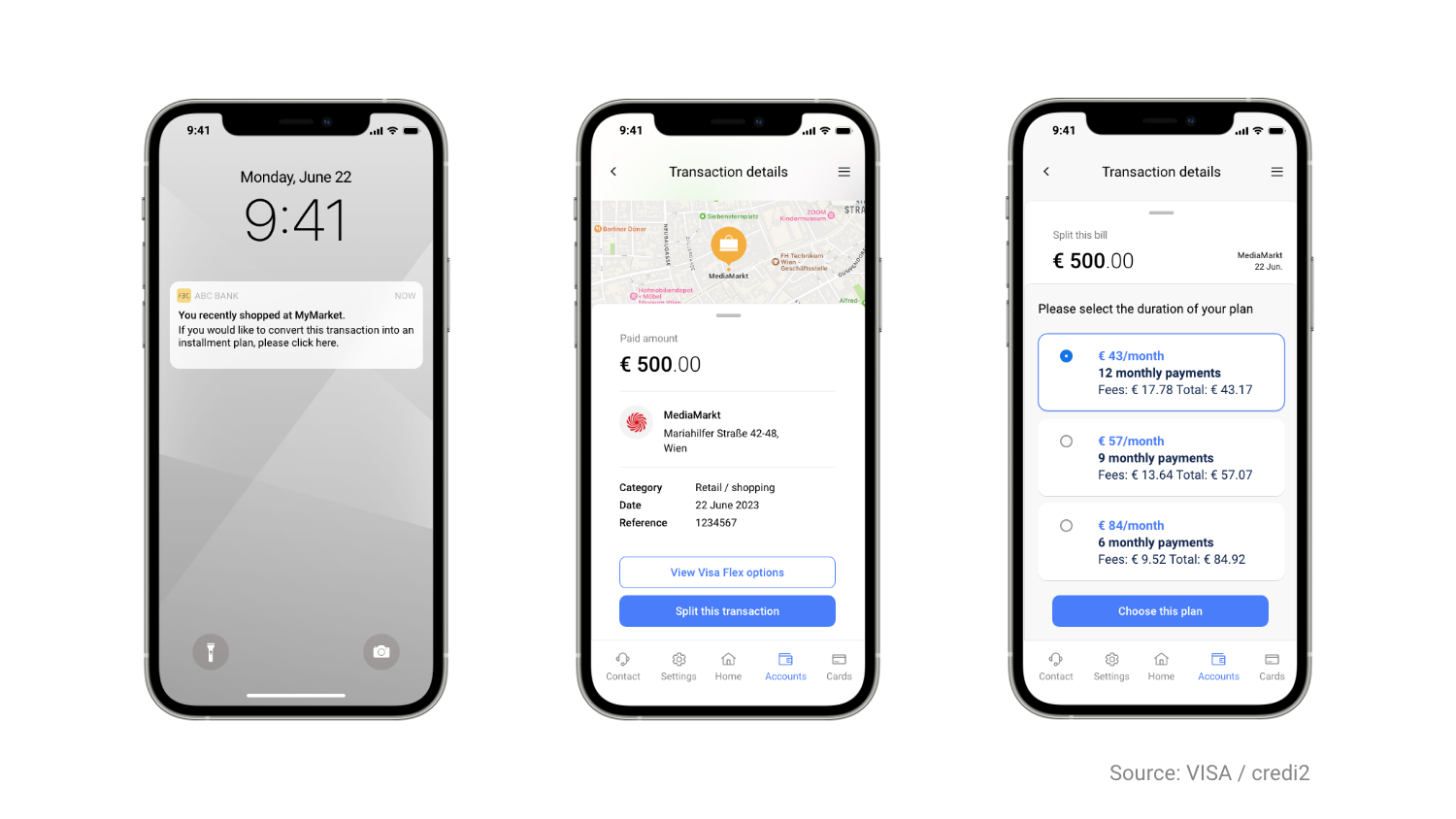

Credi2 and Visa have jointly developed an issuer-specific pay later product that can be used flexibly with charge and debit cards, unleashing the “buy now, pay later” experience through a card-led installment product. Providers that integrate this white-label end-to-end solution into their card apps will gain access to a billion-dollar market that is still largely untapped.

We sat down with our VP Product Sabina to go into more detail about this innovative payment solution and how it is solving numerous hurdles for issuers.

Q1: In a few words, can you describe what the product is about?

The product which we’ve developed with Visa is an issuer-led pay later product for debit and charge cards. It will enable issuers to integrate “buy now pay later” solutions as a feature to their existing as well as new products or channels, such as mobile banking and web banking. The feature can easily plug-and-play into their solutions and existing ecosystems. Irrespective of the complexity of their systems, the feature is easily scalable: by adding that feature to their products, it will speed up the time-to-market and will make any existing or new product more attractive to their customers. What’s important to note is that it’s developed completely product agnostic.

Q2: What are the product’s main advantages?

The main advantages are its flexibility and time-to-market, followed by an optimized total cost of ownership. Given that we are using state-of-the-art scalable modules, which are easily adaptable to any system, we can move very fast with the issuer from the concept phase into the development phase. Another important benefit for the issuer is that it’s an attractive and economically valuable payment feature which definitely enhances the product value proposition resulting in greater customer satisfaction and ultimately customer retention. As much as this is about convenience, there is,of course, also an economic value which comes with it. Any deferred payment or installment payment, because it is transaction based lending, gives the issuer enough room to charge fees or interest and ultimately get an attractive piece of a huge pay later cake.

Q3: What are the main pain points the issuer-based pay later solution is solving?

We focus on a number of determined pain points we have identified by having in-depth conversations with issuers throughout the entire process. Some pain points are related to the back-end, not being able to handle installment payments, while some issuers might face challenges with the front-end. Usually issuers’ internal systems are quite complex and integrating such features requires a lot of internal know-how, substantial investment not just in technology but also in third parties to reconcile all the necessary infrastructure needed for such features to function. We offer all of that in one “off-the-shelf” solution with a very easily integratable system. So, no matter which channel - existing or newly developed - we can integrate UX and UI interfaces, delivering this solution in such a way that it can be used very flexibly.

Q4: Financial institutions know the business, they have a trusted brand and long-lasting relationships with their customers which often go back several generations. Why exactly is it that issuers are relying on credi2 in this case to introduce such payment options?

It’s important to recognize that BNPL is currently a very popular payment option trending among all end customers. Financial institutions have been disrupted for a while now by a number of consumer-facing players in the market which went live with BNPL solutions without having to comply with a regulatory framework for a long time. Financial institutions, in contrast, have to work under a certain framework and handle their entire infrastructure and legacy, which naturally slows them down in creating comparable products. Given all the regulatory and legal constraints under which a financial institution has to move, we offer a fully compliant solution that covers the full expertise of not only onboarding but also KYC and other frameworks which are to be complied with. In other words, we are taking care of it all and have the agility and speed banks are often missing.

Furthermore, resources are a huge part of this, too. Not just the head count but moreover know-how and expertise. We have conducted a study among German bank executives and 79% stated that their systems are not BNPL-ready due to lack of IT-resources, core banking complexity, costs, and operational efforts, to name just a few. We are specialized in developing innovative pay later solutions,bringing years’ worth of payment industry experience to the table. This is of tremendous value for the lenders.

Q5: You mentioned flexibility earlier. Despite it being an “off-the-shelf” solution, the final integration is still very dependent on the issuer’s preferences. Can you talk a bit about the various use cases?

BNPL or pay later is a very broad term; however, it covers three main elements: payment per invoice, deferred payment, payment in for example three equal installments. It depends on the issuer’s desires - how they want to compete in the market, how they want to offer the actual product proposition to their customer, and what they feel is the market opportunity for the use case.

We can offer any of the use cases or a combination independently, as our solution is very flexible and scalably built. Even though it is primarily an “off-the-shelf” solution, we are ultimately creating and designing it together with the issuer in order to best suit clients’ needs.

Q6: The enormous demand for pay later services has encouraged regulatory authorities to take action. They have recognized the value of these services and now aim to turn them into more regulated channels. This, however, will not hinder the industry, but will rather strengthen it, which is especially true for banks and issuers. How does the product fit into that?

The product is fully compliant with the regulations framework financial institutions fall under. The customer onboarding as well as the management and the maintenance of the product are fully compliant. Since we are covering most of the processes around the product itself, not just enabling it for the lender, but also managing the product life cycle, we have to be end-to-end fully compliant with all regulatory requirements. It goes without saying that we have a legal and regulatory assessment built in by default for every product. Our compliance team is fully involved and dedicated to maintaining the highest level of compliance throughout the entire process.