Hauptinhalt

An unstable economic environment, high interest rates, and a general economic slowdown - looking back at 2022 these were some of the most talked about topics pertaining to the fintech world. Looking back a couple of years, amidst a severe global health crisis, BNPL was on the rise. Online shopping was a pastime for many during the lockdowns and being able to spread the cost was a very welcome, convenient feature. This continued even after physical shops reopened and people were freed from their confinements. Now, facing a challenging economic situation it seems that the pay later industry has reached its end. But has it really? And what is actually meant by “BNPL” nowadays?

In recent years and through the evolution of the industry, many different interpretations have emerged. Classical BNPL is a type of short-term financing that allows consumers to make purchases and pay for them at a later point in time, often interest-free. Typically this includes purchase on invoice and installment purchase. However, due to newly introduced payment features the definition has broadened and has often been referred to as “pay later”.

The term encompasses all deferred payments including factoring products such as the aforementioned purchase on invoice as well as loan based products like installment loans and revolving credit. Now let’s take a look at some pay later trends for 2023 and how the industry will evolve.

What does the current recession mean for the pay later business?

Here are the facts: Inflation is high, the price of commodities and services is rising and life is getting more expensive. Consumers’ need for more control over their spending will increase. In order to continue the current purchasing trend and maintain the standard of living, consumers will have to rely more on borrowing money than before. Trapped between high inflation, low deposit rates and diving stocks, many consumers will find it increasingly difficult to postpone the purchases they have been planning. Therefore, the importance of pay later will continue to grow despite the current situation as such features enable consumers to smartly and conveniently manage their liquidity.

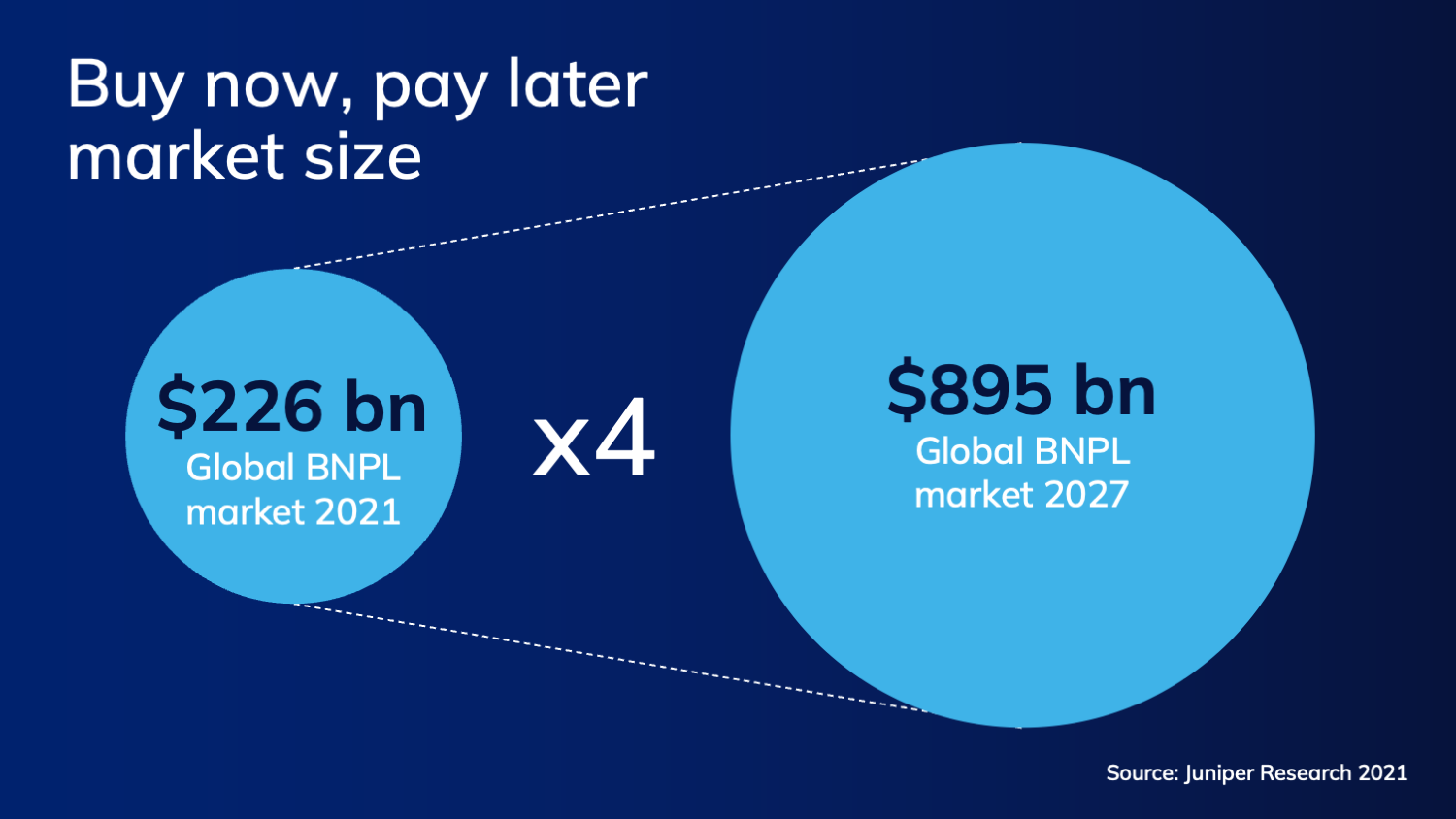

According to a recent study by Juniper Research, spending via pay later services will reach $895 billion by 2027, from $266 billion in 2021. New, recent industry entrants such as Apple Pay Later or Amazon, prove just how relevant the industry is. Check-out shares will continue to grow. Numerous retailers can corroborate e-commerce check-out shares of 30% to 50%, and in individual cases even up to 80%. But what about the regulation and increased Euribor - is it hindrance or a chance? Admittedly, many B2C fintechs will struggle to keep up, especially now that the refinancing costs are at an all-time high since the economic crisis in 2008/2009.

The real question is, was their business model really that good and bulletproof to begin with? It did offer a convenient and fully integrated way to consumers to finance their spendings, however embedded finance is not new to banks either - especially not the ones that work with a pay later technology provider.

What is crucial right now is for banks to exploit their many advantages over consumer facing fintechs and enter the pay later market. They have the necessary liquidity and the trust and relationship with retailers being their principal bank. Irrespective of the interest rate level, there is a trend towards making payments more flexible, away from one-offs and towards splitting them up. This is something that is not going to change, quite the opposite: there will be even more ways to split up payments.

In which markets might pay later gain momentum?

Expanding choices are changing the pay later field for consumers, banks and the increasing number of consumer-facing pay later fintechs. Up until now we have mostly seen and used merchant based BNPL which includes BNPL products directly integrated at the merchant check-out, in-store and online. This includes BNPL pure players such as Klarna or Ratepay. While it’s very convenient and simple to use, it limits the consumer to decide to split their spending amount exclusively at the time of purchase. We are currently observing a notable shift in terms of the demand for BNPL, which is moving beyond consumer facing fintechs towards a significant group of classic credit / loan providers - be it consumer cash or POS loans. This will surely have an effect on how pay later options are accessed and used by different consumers. Furthermore, this is driven by responsible lending, the lasting demand of payment flexibility and the convenience through the digitalisation of financing products.

Credit cards: Splitting payments post-purchase

Nowadays the focus is first directed on the consumer experience and working backwards, keeping several pay later options in mind. Many, including consumers and traditional banks, have realized that there is enough space in the pay later world for both installment loans / split pay and revolving credits. Many consumers have a credit line (open to buy) on their charge or debit cards available by their trusted provider and have no interest in creating a new separate BNPL account. Therefore, adding a BNPL 'split pay’ option to their existing card line is a great feature for them. Not to mention, some consumers may not be up-to-date with current pay later offers out there and much rather prefer to look at their trusted banks for reliable pay later options.

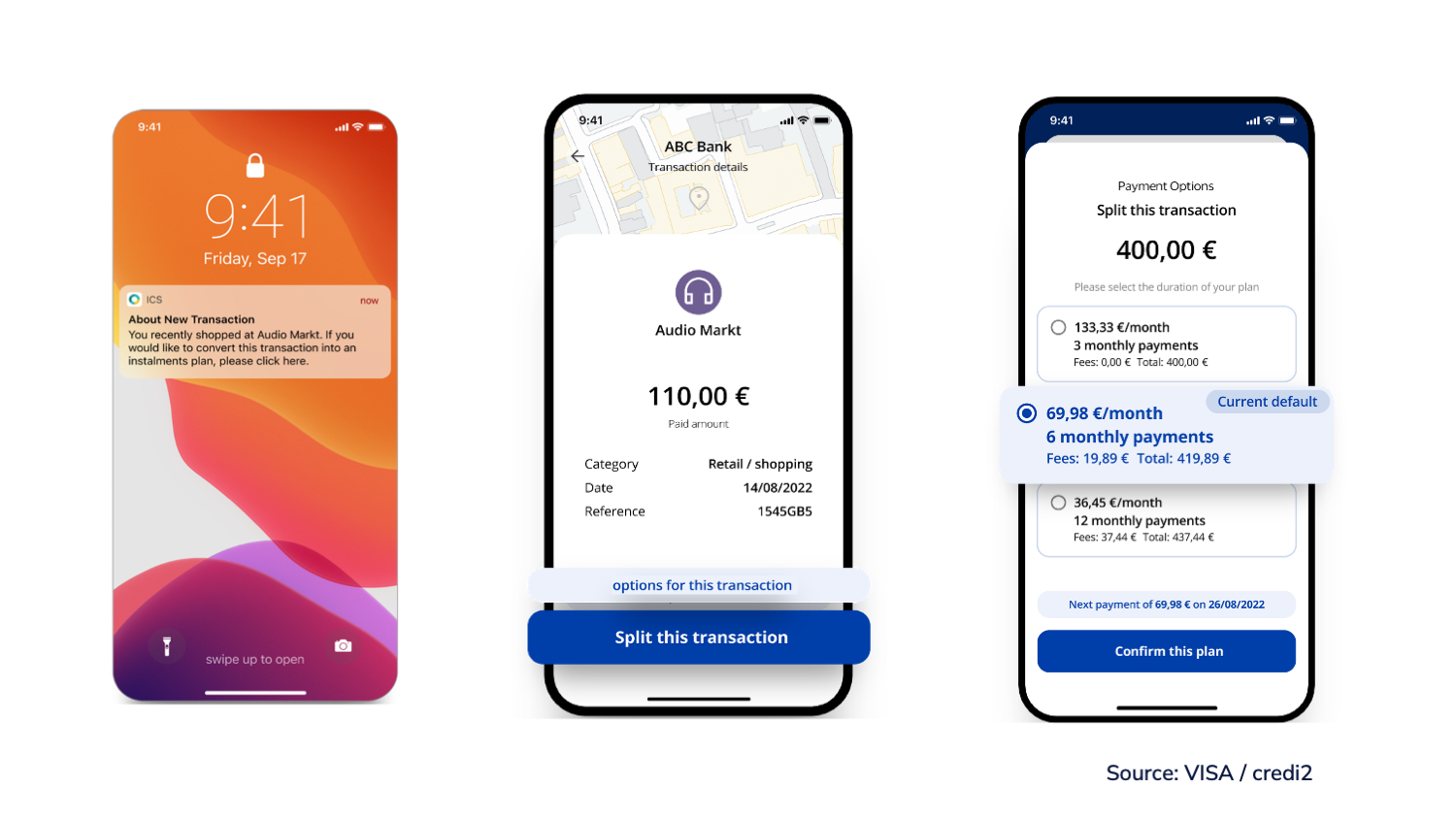

Furthermore, some merchant-led options such as Klarna are only available at certain merchants, which might be confusing to some consumers, stressing the importance of making pay later a part of their existing cards they use on a regular basis. Moving forward, issuer-led loans will take up more and more space in the pay later world. That way, consumers will be able to shop and pay by card, and have the possibility to split their spending later that day or even the next day by comfortably accessing their credit card app and choosing their preferred split option. It removes the need for immediately deciding at the time of purchase whether the consumer wants to split their payment and gives them the opportunity to decide later.

We have seen numerous issuers and schemes entering the pay later market with similar solutions, the latest of which is the leading credit card scheme Visa. Joining forces with credi2, Visa developed an issuer specific pay later product that can be used flexibly and that will in future facilitate buy now, pay later payments with Visa credentials in the Central European markets and beyond. Providers who integrate this white-label end-to-end solution into their card apps will gain access to a billion-dollar market that is still largely untapped.

How can consumers mitigate the risks that come with pay later?

Regulatory authorities have recognized the value of pay later services and the enormous demand has encouraged them to take action and turn them into more regulated channels. Despite what many might think, this will not hinder the industry, but will rather strengthen it.

Until now, market participants have been able to take advantage of exceptions in the online area that are not available to traditional financial institutions, and thus gain an advantage. By holding pay later to the high standards expected of other loans and forms of credit, the upcoming consumer credit directive will protect and foster a safe growth of this innovative market. European banks support this.

As a survey by Credi2 among 120 decision-makers in European banks shows, a large majority of more than 60 percent calls for market regulation in competition with non-banks.

The aim of the directive is that in the future the same competitive conditions should apply to all credit providers, both online and offline. This also applies to pay later, as follows:

- Protection rules for loans under 200 euros

- Marketing: There will be more prominent and detailed information on the conditions for online quick loans. The EU wants this information to be designed in a similar way to warnings on cigarette packs in order to draw consumers' attention to the risks.

- Stricter credit checks: The aim of the assessment is to check whether the consumer is able to meet his/her obligations.

- Right of withdrawal: The right to withdraw from a credit agreement without giving a reason within 14 days should apply.

Banks have done a good job all along when it comes to protecting their consumers, after all this is one of their major responsibilities. Responsible lending is a core part of banks’ business and it means that they act in a customer’s best interest by ensuring affordability, transparency of terms and conditions and offering support to borrowers if they are facing repayment difficulties.

With several additional options to the pay later sphere, stricter regulations in favor of consumers and exciting new partnerships between financial institutions and start-ups, this year will certainly be focused on even more user-friendly, customer centric and convenient pay later solutions.