Hauptinhalt

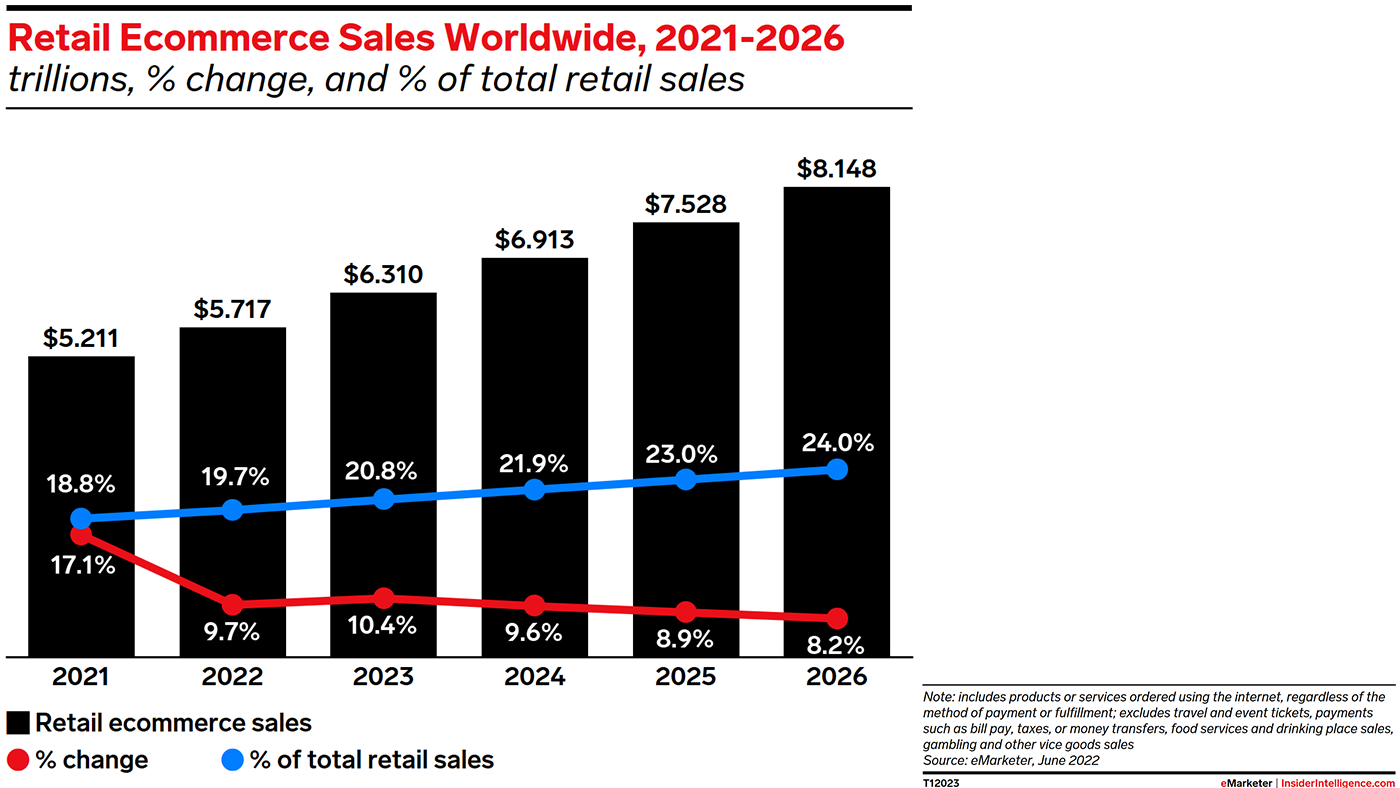

Even if e-commerce continues to boom, it is crucial to offer flexible financing options at the POS (point of sale). After all, it’s still where three-quarters of the revenue is made. A recent study by eMarketer shows that $5.7 trillion in 2022, $6.3 trillion in 2023, and $8.1 trillion by 2026 will be turned over in e-commerce worldwide. However, these impressive numbers should be treated with caution: they signify that growth in e-commerce will flatten out in the next few years. Online shopping grew by 17.1 percent in 2021 compared to the previous year but growth is expected to slow down to around 8 percent by 2026.

In 2022, e-commerce accounted for around 19.7 percent of the total retail market, and by 2026 the share will rise to 24 percent, according to the eMarketer study. This means that the offline retail market will still be three times larger than e-commerce in 2026. Anyone who relies on smart BNPL financing options (“Buy Now Pay Later”) should not miss this opportunity because BNPL also works at the point of sale at physical stores.

BNPL has gained a lot of popularity in recent years, especially in the retail world. It turned into a preferred service not only in online shops but also at the POS, as it comes with numerous advantages for both customers and retailers.

Increase in conversion rates by up to 30%

Retailers can use BNPL to their advantage as the financing solution enables them to make more sales and sell more expensive products easily, especially in times of high inflation. It turns out that consumers are more inclined to make more expensive purchases if they have the option of paying in installments. BNPL can also help build customer loyalty as customers often return to make more purchases using the same payment method. An analysis by the BNPL specialist credi2 shows that conversion rates at the POS can be increased by 15-30 percent.

The best example of the successful use of BNPL at the POS is FINANCE A BIKE, which credi2 implemented together with Volkswagen Bank. Customers can finance their dream bike worth up to €12,000 with a quick loan in thousands of partner shops throughout Germany. The retailer initiates the financing request at the point of sale, and the customer receives a link to the BNPL application via text message on their smartphone. It takes only 5 minutes from the financing request to the payment.

Flexible alternative to credit cards

“Consumers expect a seamless omnichannel experience and thus the same payment flexibility at the physical POS as in online shops. With modern, easy-to-use, fast, and 100% digital financing methods such as installment loans, split-pay, or payment on account, consumers can be served with the same advantages that they are familiar with from e-commerce,” says Christian Waldheim, Co-CEO of credi2. “Smart integration at the POS allows retailers to free their own staff from complex processes. You ultimately benefit from more time with the customer, higher shopping carts, and more sales.”

This makes BNPL an alternative to credit cards, which, unlike in the USA, are not as widespread in Central Europe. Especially retailers who want to address younger target groups of Generation Y and Z (born after 1981) with a financing solution can benefit with BNPL. Around 75 percent of BNPL users belong to Gen Y and Z - for them, such solutions have become the standard alternative to credit cards both at the POS and in online shops.

One of the biggest advantages of BNPL is that it gives customers more flexibility and control over their spending. Customers can immediately afford expensive purchases (e.g. bicycles) without breaking their budget or overburdening themselves financially. That way, with trustworthy providers like credi2, which meet strict specifications, merchants do not run the risk of payment defaults. This is because the creditworthiness of users is carefully checked in accordance with strict guidelines.