Hauptinhalt

1. Strong and established vendor positioning in the white-label BNPL space

credi2 has satisfied all criteria in terms of high performance in size & strength of existing customers (capability and capacity) and partnerships, as well as in depth of the offered solution and innovation of pay later services (product and position). With that, we have been positioned as the #1 established leader for white-label BNPL solutions, in front of competitors such as Jifiti, Divido, Unzer, and Splitit.

2. Credi2 offers a 360 degree ’pay-later‘ product range, going beyond split-pay and pay-per-invoice

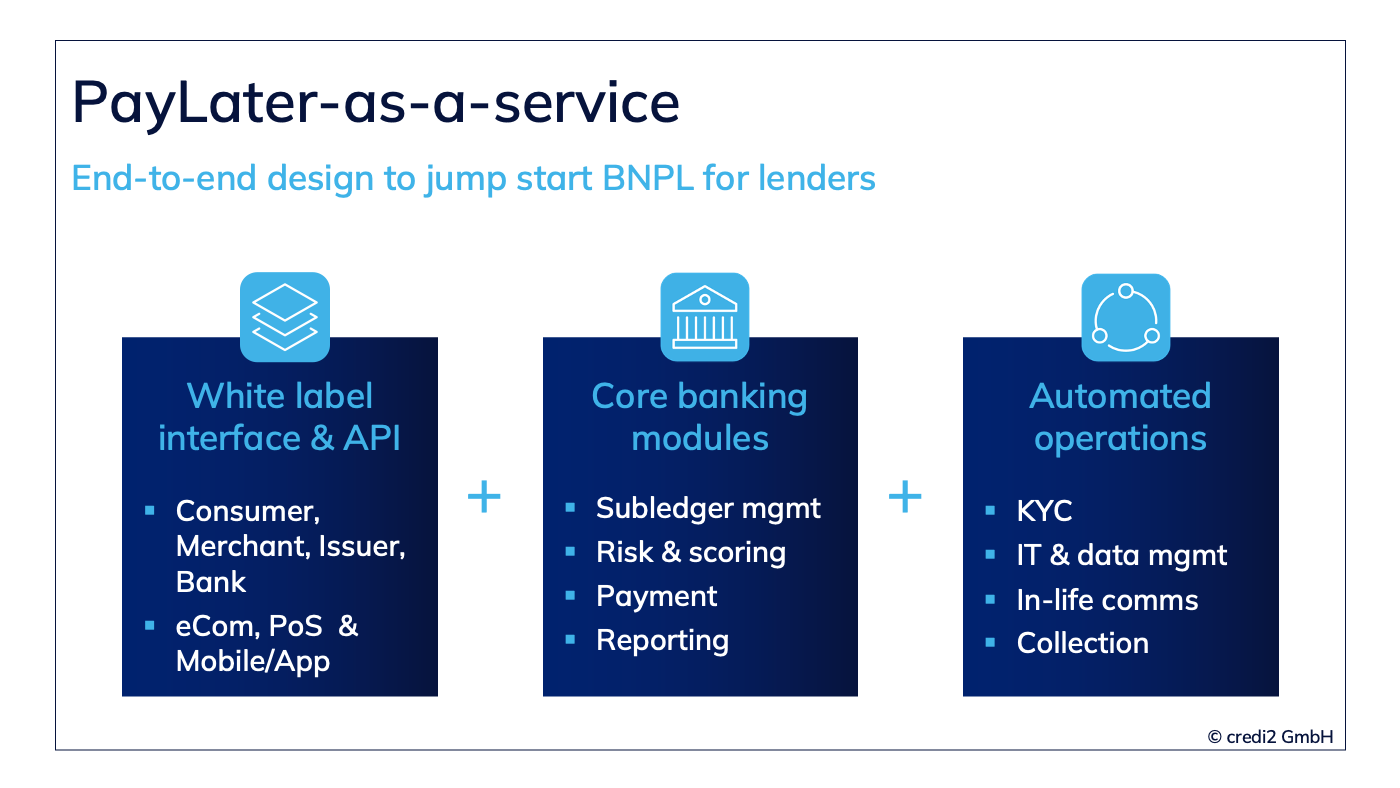

We offer end-to-end pay later solutions to banks and issuers on a white-labeled approach. Based on our awarded Pay Later-as-a-service platform, we enable pre-, at- and post-purchase use cases, through its financing products such as installment loans, revolving credit, pay-per-invoice, and split pay. Due to this modular approach we enable lenders to easily unlock the pay later potential by utilizing pay later front ends, related core banking modules including subledger management as well as automated operations. This results in a fast time to market, unmatched products, and significantly reduced implementation & operational efforts.

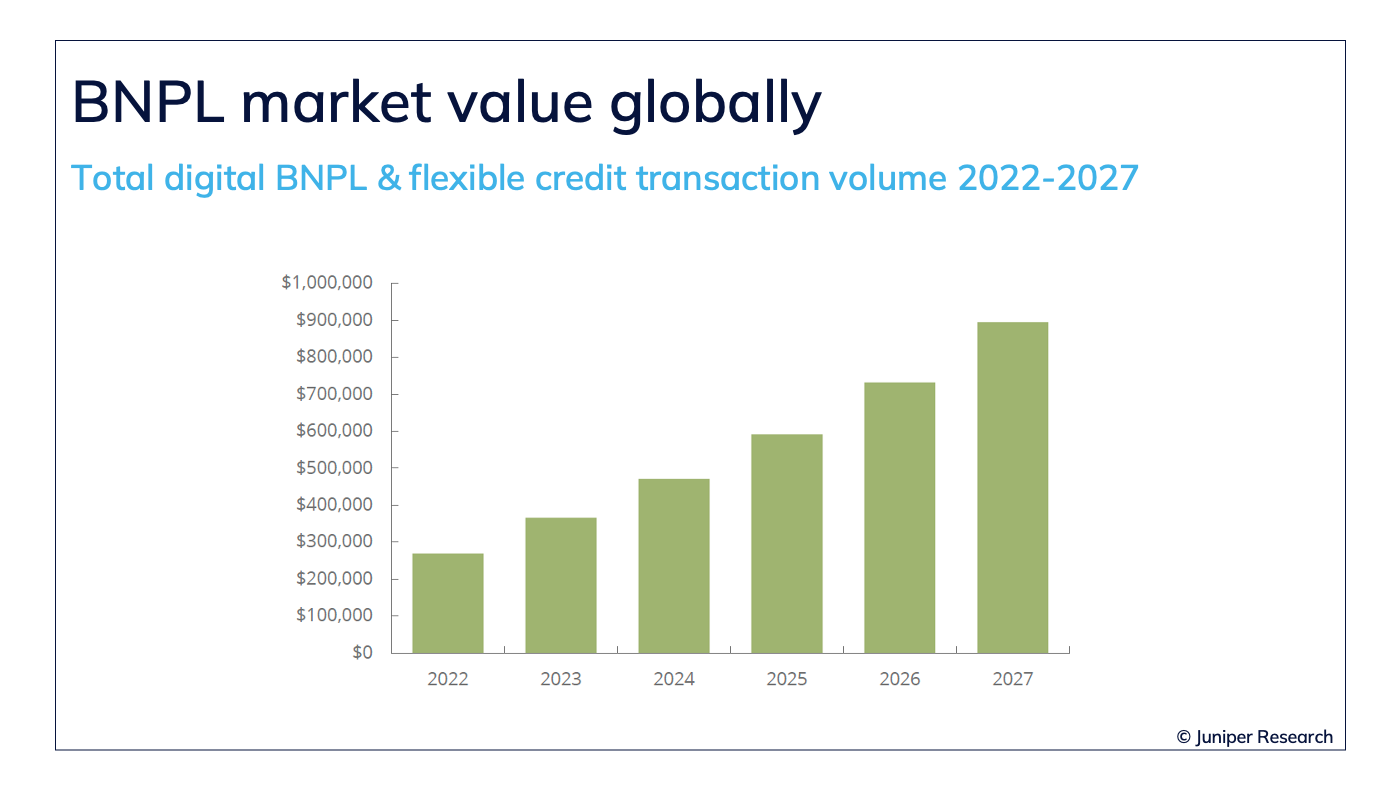

3. Potential of BNPL is expected to increase to $895 globally by 2027 (increase from $268 billion in 2022)

White-label BNPL is an emerging market with many important use cases and revenue streams providing a valuable opportunity for both merchants and banks. With its automated processes and modular approach, credi2 enables banks to enter the BNPL space, adding a new area of potential revenue.

4. With the PayLater-platform, credi2 offers a compelling value proposition to all three key stakeholders in a transaction – the consumer, the merchant, and the lender – which has helped the category gain popularity.