Hauptinhalt

Let's grow your business.

With the right retail financing product.

Credi2 has everything you need to run your own buy now, pay later (BNPL) financing solutions. Seamlessly integrated with your eCommerce or Point of Sale business.

- Design your 'payment journey' spot on

- Leverage our automated BNPL-as-a-service platform

- Skip additional IT and operation hassles

- Easily integrate with APIs and Plug&Ins

Key platform features

In-house development and operation?

We'll liberate you.

More growth. More control.

We'll do that for you.

- Easy integration via API or plug&in. We run IT, processes and operate everything for you. Incl. customer support if needed.

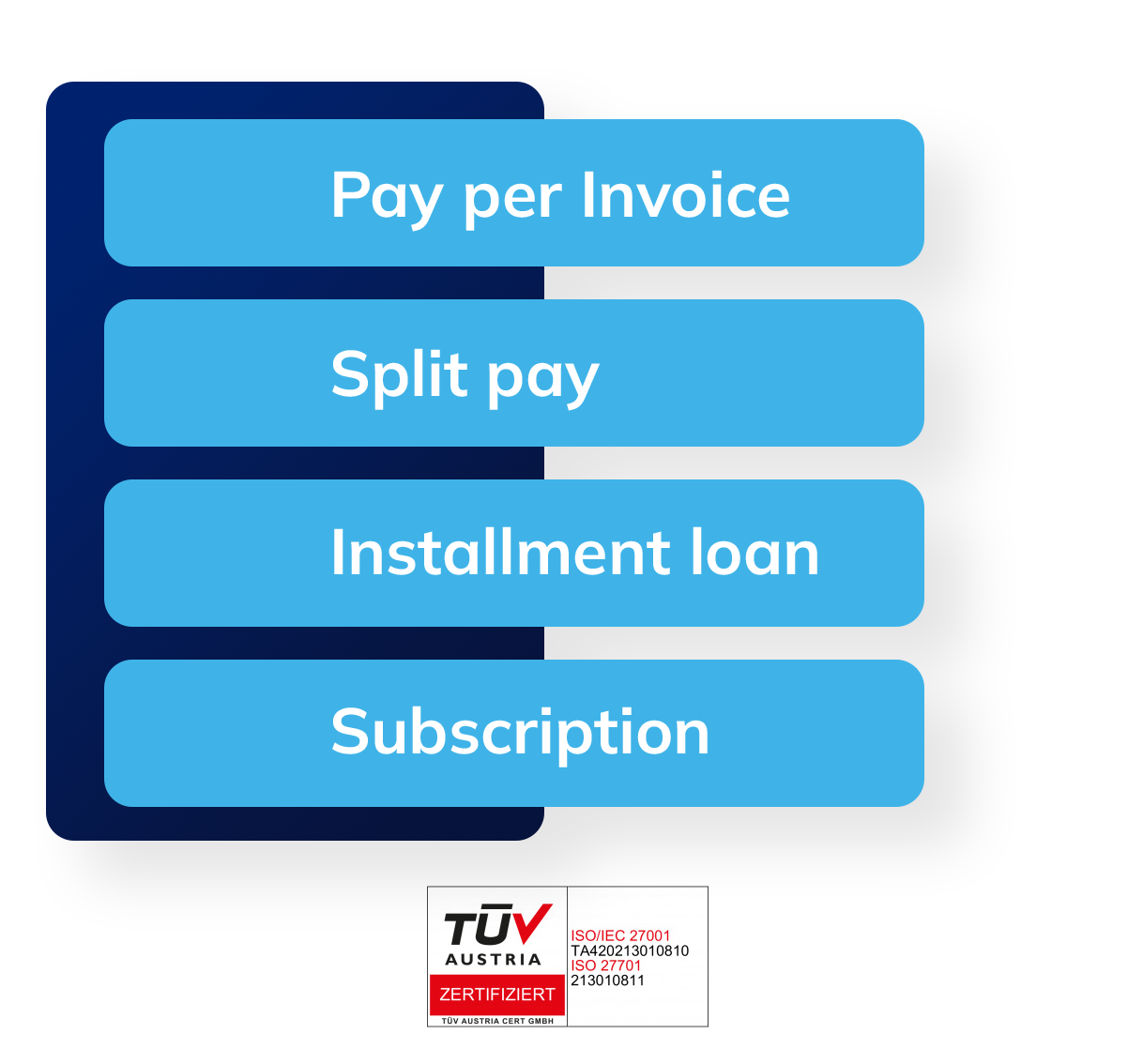

- Pick the best retail financing method to acclerate sales: Split pay, pay per invoice, instalment loans or game changing subscription payment

- Faster pay out. Better liquitity. Better commercial rates.

- Own your business at better conversions. Higher customer satisfaction. A just better customer life time value and therefore incremental growth.